Successful IPO for Exosens

Wednesday 12 June 2024

Natixis Corporate & Investment Banking, working closely with Oddo BHF, supported the successful IPO of Exosens, a European leader in high-end electro-optical technologies, on Euronext Paris.

Carried out in the form of a private placement with institutional investors, the Initial Public Offering (IPO) generated extremely strong demand both in France and the international market.

Launched on June 3, the price was set at €20 per share, valuing the company at nearly €1 billion. The size of the basic offer was increased from an initial €300 million to €350 million on June 5 in response to strong investor demand, and could reach as far as €402.5 million if the over-allotment option is exercised. The offering includes a capital increase of €180 million, providing Exosens with the funds it needs to finance its expansion.

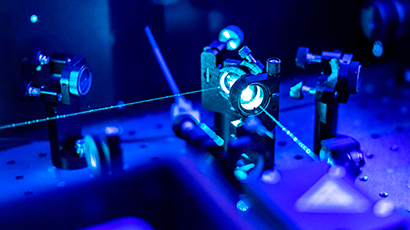

Natixis CIB, working closely with Oddo BHF, acted as Joint Bookrunner on this transaction, the largest IPO in France in the past three years, which confirms the revival of IPO activity in Europe and the attractiveness among investors of the defense sector, as Exosens provides innovative imaging and detection solutions for defense and industrial applications.