The sports industry: the challenges of a champion

[January 2023] Groupe BPCE, a Premium Partner of the Olympic & Paralympic Games Paris 2024, publishes a new edition of its BPCE L'Observatoire report devoted, this time, to the sports economy.

The report provides a more in-depth analysis of the transformations of sporting activities along with a focus on the fundamental role played by local authorities. And, for the first time, BPCE L’Observatoire assesses the economic impact of this industry on French GDP based on the various contributions of all the players actively involved in sport.

A dynamic industry faced with many challenges

A far-reaching transformation in sporting practices was already underway before the onset of the health crisis. This critical event hastened the pace of certain trends and revealed a number of weaknesses notably in the activities pursued by associations whose decline in the wake of the pandemic is a cause for concern.

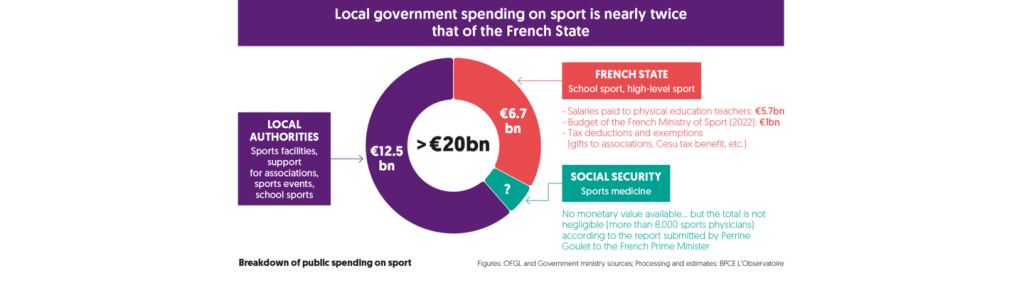

The public sector supports sport to the tune of €20bn every year with local authorities especially acting as the principal sources of financing for amateur and local sport, spending a total of €12.5bn every year, in particular through their stock of existing sports facilities.

Today, local sports policies are facing a host of multifaceted challenges related to the impact of inflation, changing needs, the ageing of certain sports facilities, and the energy transition.

Beyond the public sector and network of associations, the sports industry boasts a rich array of private companies analyzed in this study through the prism of a new sectoral segmentation. The exhaustive approach covering the different players in the sports economy now enables us to assess the impact of the sports industry at 2.6% of French GDP, and to provide an analysis of its structure and specific characteristics.

– The principal research results in 1 minute… click here –

Local and regional authorities, the principal source of financing for sport

Local and regional authorities are the principal source of financing for sport in France. Their contribution is estimated by BPCE L’Observatoire at €12.5bn, which is almost double the State budget devoted to sport, including the state education system.

More specifically, municipalities provide the lion’s share of this financial contribution, for a total of €8bn. They also make indirect contributions considering that intermunicipal authorities allocate €3.1bn to sport every year, most frequently on top of the contributions made by the municipalities.

Local authorities, which own 81% of the 318,000 sports facilities throughout France, devote a significant part of their budgets to investment in the construction of new, and the renovation of existing, facilities equal to a total of approximately €4.5bn per year. Current expenditure is devoted to sports facility operating costs and subsidies granted to associations.

Sport is the second largest expenditure item for municipalities after education, and is considered a priority by elected officials. In their eyes, it represents a vector for greater territorial cohesion and social inclusion, and even a response to public health issues or economic attractiveness. Sports policies are often pursued in close cooperation with members of the association ecosystem that embodies a non-profit model providing access to all.

The sports industry in France: 2.6% of GDP

With 128,000 companies identified, the sports industry confirms not only the wealth of its diversity but also its vitality with the creation of 10,000 to 15,000 new companies every year. Highly heterogeneous in nature, the private productive fabric of the sports sector tends to be demographically fragmented but concentrated from an economic point of view.

There are 101,000 companies with zero employees, chiefly active in teaching and coaching and accounting for less than 10% of the industry’s aggregate turnover. A total of 3,500 SMEs, intermediate-sized enterprises, and large corporations, chiefly operating in the retail, sport entertainment and manufacturing segments, account for €51bn of the €71bn annual net sales generated by the industry overall.

€71bn Net sales generated by companies in the sports industry

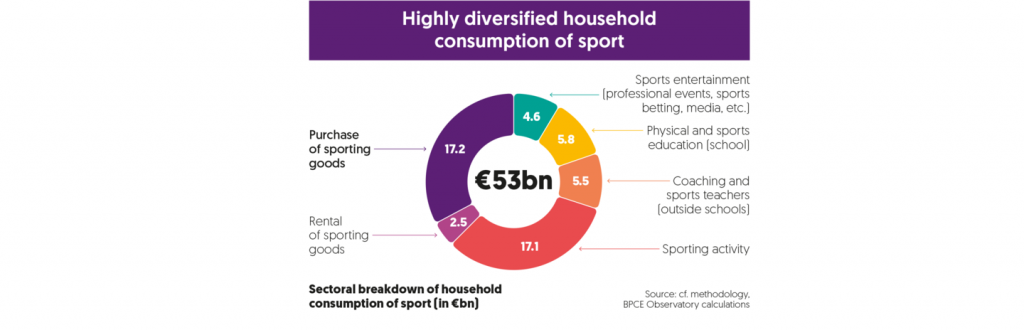

Based on the work carried out on the various economic agents active in the sports industry, BPCE L’Observatoire estimates that sport contributes 2.6% to French GDP, equal to a total of €64bn. The final consumption by French households of sports goods and services accounts for €53bn of this €64bn contribution to GDP. This consumption is calculated using data related to sport company activities and transfers from associations and public administrations.

Investment in sport, chiefly calculated using corporate and local authority accounts, stands at €12bn. However, the large share of the non-market sector (valued at production costs rather than market prices) and the importance of the positive externalities produced by sport (volunteering, public health, social cohesion, etc.), represent traditional limits to a fair measurement of GDP, leading to an underestimation of the place of sport in the French economy and society at large.

Previous achievements weakened and a great many challenges ahead

The diagnosis of a powerful ecosystem, however, buoyed up by an underlying trend provides an overly flattering portrait of the industry.

As far as the private productive fabric is concerned, the number of very small companies employing between 1 and 9 people has been declining since 2016, chiefly in favor of self-employed entrepreneurs but also, and to a lesser extent, in favor of SMEs, thereby further accentuating the polarization of the industry.

The capacity for organic and acquisition-driven growth of any industrial sector is liable to be compromised if its productive fabric is no longer driven by very small companies enjoying the potential of developing into future SMEs.

In addition to this structural fragility, the sector has suffered the impact of the many recent shocks resulting from external factors (COVID, inflation, energy and climate transition, etc.). According to our assessment, local authorities in a full year could be faced with a 12% increase in their expenditure on sport, i.e. a total of €1.5bn, of which more than half is expected to be driven by the rise in energy prices. At a time when elected sports officials are uncertain about how to respond to new sporting practices, climate change, the difficulties facing associations, etc., an increase of this magnitude risks triggering a review of spending on sport and a reappraisal of investment policies in favor of energy-efficient renovations at the expense of the commissioning of new facilities. The energy mix of sports facilities remains largely fossil-fuel dependent and 58% of pre-1985 infrastructure has not benefitted from any significant renovation work.

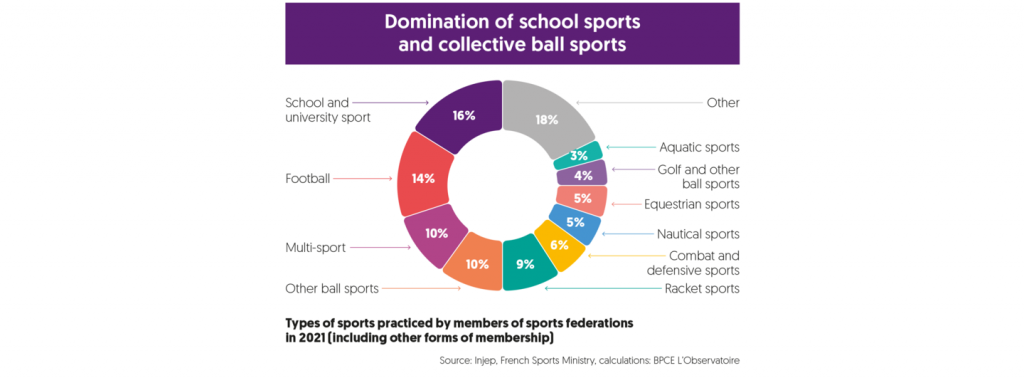

The final challenge facing the industry concerns the practice of sport itself. The long-term increase in the number of sports federation licensees (from 2 million in 1950 to 16 million in 2017) was interrupted even before the advent of the health crisis. The magnitude of the decline directly related to the health crisis (4 million fewer annual and one-time licenses between 2019 and 2021) and its even greater impact among working-age women show that the continued growth of sporting practices, along with its trend toward greater feminization, are more fragile than they appear at first sight. The goal of 3 million additional people practicing a sport in the run-up to the Olympic & Paralympic Games Paris 2024 may be difficult to achieve without support.

– 22% Decline in the number of sports association license holders between 2019 and 2021 (including occasional participants).

For further details (only in French)

BPCE L’Observatoire – Economie du sport, janvier 2023

DOCUMENT PDF – 7,6 MB

Consult here all studies published by BPCE’s experts on the sports economy