What lies ahead for the residential real estate market in 2023-2024?

[April 2023] Groupe BPCE’s economists share their analysis of the market situation and their forecasts for 2023-2024. The combined impacts of inflation, the mandatory energy performance diagnosis (EPD), and rising interest rates are weighing down on the real estate market.

The new build sector squeezed between rising costs and declining household solvency.

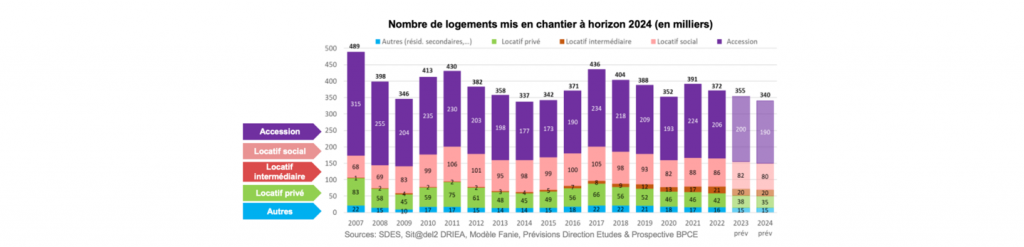

After 2022, a year when new housing starts declined to a level close to their ten-year average, the year 2023 began with a monthly new construction rate below the 30,000-unit mark. The new-build sector has borne the full brunt of successive waves of negatively impacting events: the Covid-19 crisis, the new RE2020 environmental regulations, shortages of building materials, and the general rise in inflation. The increase in the construction cost index, which is easily outstripping the rise in consumer prices, is a source of considerable upward pressure, further exacerbated by the resilience of land prices relative to the wider economy. The winding up of programs in the large Integrated Development Zones (Zones d’Aménagement Concerté or ZACs) with a fragmentation of the supply of land available for private players, the implementation of the Zero Net Artificialization measures in less densely populated areas, and the adoption of policies designed to limit urban density in large cities are making it increasingly difficult to obtain building permits in both densely and sparsely populated areas, and are helping to keep land prices high owing to the scarcity of supply.

The real estate development sector, which has already found it difficult to replenish its supply over the past two years, seems to be facing a sharp decline in demand. Reservations in Q4 2022 fell by 30% compared with Q4 2021 (the lowest 4th quarter since 2008) despite the positive impacts of the tax benefits offered by the so-called Pinel tax reduction scheme until the end of 2022. Another sign of the weakening in demand is the cancellation rate, affecting a total of 20% of quarterly reservations. The inventory of unsold properties rose to 114,400 units at the end of December 2022, equal to nearly 15 months of sales. Faced with rising costs accentuated by higher expectations regarding housing quality and a simultaneous decline in household solvency triggered by the increase in interest rates, the real estate development industry needs to take a fresh look at its business model. Geographical diversification into the more relaxed real-estate markets in the B2 and C zones – to avoid the constraints of limited land availability in very densely populated areas – only provides a partial response to the problem owing to the faster increase in unsold inventory in these less tense real estate markets.

In the single-family home market, the number of reservations has declined significantly after two good years in 2021-2022. Deeply impacted by the zero net artificialization target and more sensitive to the tension between costs and prices owing to their more frequent positioning in the low-income homebuyers segment, single-family home builders are also adapting their business model, notably by diversifying into home improvements and renovations. Finally, social rental housing has also been hard hit by the rise in the rate of interest paid on Livret A passbook savings accounts and by the need to undertake energy renovation work with the related mobilization of a significant portion of the companies’ own financial resources.

Overall, the limited availability of land, higher construction costs, declining household solvency, and the refocusing of housing policy on energy renovation should continue to weigh down on new construction in 2023 and 2024, with new housing starts falling to 355,000 and 340,000 respectively for each of these two years.

Housing demand remains strong yet less buoyant than before.

In early 2023, household pessimism was more pronounced than during the Covid-19 crisis in 2020, notably with respect to their purchasing power. This pessimism is reflected in a decline in intentions to buy a home over the next two years. Only 14% of French households currently think that now is a good time to buy (compared with 34% in February 2022) with 45% considering that now is not the right time. This highly negative view of the economic situation does not translate into a loss of confidence in real estate, however; the desire to own one’s own home remains very strong in society overall, and a majority of French people continue to anticipate growth in real estate prices over the next 12 months as well as over the next 5 to 10 years. As a result, when surveyed in February 2023, 17% of French people said they were planning to buy a home in the next 12 months, down just one percentage point from February 2022 but up from the low noted in November 2022. However, when the focus is placed more specifically on the second home and rental property segments, we observe a decline in intentions to buy among the highest income earners and the most affluent categories of the population, a trend that foreshadows a significant downturn in rental property investment in the short term.

17 % of French households are planning to buy a home in the next 12 months

Regarding intentions to sell, the trend is stable or even oriented slightly upward, enabling the market to anticipate a flow of new housing opportunities. About half of potential sellers worry about how long it will take them to sell their properties or their ability to find a buyer prepared to pay the asking price (47% and 46%, respectively), two indicators that have declined marginally without representing a radical departure from the trend observed in the previous quarters. Faced with the alternative of selling at a lower price or waiting for the market to revive, 60% of potential sellers say they prefer to wait and postpone the sale; this behavior is fairly typical for periods marking the beginning of a decline in the real estate market, signs portending a market slowdown, first in terms of supply and then gradually with a greater emphasis on prices. All in all, despite the decline in purchasing power and the rise in interest rates, household demand for real estate has not collapsed but has entered a period of doubt, selectivity, and longer lead times for project completion.

The energy performance diagnosis (EPD) is having a growing impact on prices but one that is still limited on the demand for energy renovation.

Responsible for approximately 30% of final energy consumption and 17% of greenhouse gas emissions, residential real estate plays an important role in the French national low-carbon strategy. The acceleration of the energy transition timetable and the shift from information to constraint, with a ban on reletting homes rated G (the worst performance) in 2025, F in 2028 and E in 2034, have profoundly changed the impact of the EPD on French people’s real estate choices today.

Currently, 74% of potential buyers consider that the EPD is a decisive criterion in their purchase decision, with 16% holding the opposite opinion. Faced with an F- or G-rated property, only 14% say it would not influence their choice, 30% would consider buying the property if the price were attractive while 43% prefer to look for a different property. At the same time, for about one third of sellers, the EPD played a role in their decision to put their properties up for sale. The growing selectivity of French households vis-à-vis the EPD is expected to reinforce the traditional trend whereby house price differentials are further exacerbated by the premium attracted by trouble-free properties and the discount imposed on less desirable homes in times of market decline.

74% of buyers consider that the energy performance diagnosis is a decisive criterion for them

This phenomenon is expected to have a greater impact on small rental properties and on individual homes, where the price gap between houses rated F or G and those rated D often reaches 15%, according to the notaries’ annual survey. The implementation on April 1, 2023 of the energy audit, chiefly for single-family homes, should further widen this gap by providing an objective assessment – via an estimate of the improvement work required – of the negative ‘green’ value of F- or G-rated properties.

While the French seem increasingly aware of the ‘price signal’ transmitted by the EPD, there seems to be no significant change in their appetite for energy renovation work, an attitude apparently out of step with the greenhouse gas reduction objectives assigned to residential property. Over the past 18 months, the proportion of French homeowners considering such work within the next five years has remained stable at 39%, at a time when 70% of them say they are nevertheless considering undertaking work to embellish their properties. What is more, the low efficiency of the ‘one-off’ nature of most of the work undertaken is poorly aligned with the requirements for overall renovation work that is certainly more expensive but, ultimately, far more efficient. Even among landlords, who are more directly concerned by the energy-efficiency measures in question, there is little appetite for carrying out this work in the short term because, for the most part, they are either unaware of the EPD rating of their rented accommodation or they are over-optimistic about its level.

As a result, while the inclusion of the EPD in the assessment of property prices is well advanced, its impact on the decision to undertake energy renovation work is still limited in scope, thereby limiting the probability of achieving the greenhouse gas reduction objectives set for residential real estate for 2030.

What is the scenario for prices and transaction volumes against a background of a sharp decline in household solvency?

The rise in home loan interest rates, which began in Q1 2022 following the tightening of the ECB’s monetary policy, is showing no signs of letting up in 2023, and is expected to continue in 2024 with an average rate of 3.7% for new loans repaid over a period of more than 10 years (excluding insurance and other ancillary costs). The monthly update of the usury rate since February 2023 has, in part, enhanced the market’s liquidity. This renewed amplitude will allow interest rates on real estate loans to rise more quickly in line with the financing costs borne by lending institutions, which currently remain higher than the average ECB refinancing rate (3.5%) and the interest on 10-year OAT French government bonds (varying between 2.5% and 3.25% over the first four months of 2023). This movement will make it possible to reintegrate part of the demand that had previously been excluded by the scissor effect between the level of home loan interest rates, revised at monthly intervals, and the level of the usury rate, which changed every three months.

This upward trend in interest rates has led to a loss of household solvency and has significantly compromised the projects pursued by the French. In February 2023, more than 70% of French people with plans to buy real estate felt that their project has been impacted by the higher interest rates, leading either to renunciation, postponement, or modification of the scope of their projects.

70% of French people with plans to buy real estate consider themselves impacted by the rise in interest rates

On an ex-ante basis, the decline in the borrowing capacity of individuals with the same income and the same borrowing conditions between 2021 and 2024 would be in the order of 25% to 30%. Does such a decline in borrowing capacity imply a sharp fall in prices? This scenario does not seem to be the most likely. On the one hand, changes in borrowing conditions – with continuing changes in the required size of down payments and the length of mortgages – should only play a minor role in the closing of this gap. On the other hand, the decline in solvency should not be measured ex ante but by taking account of nominal income growth. Assuming that the average borrower’s income keeps pace with gross disposable income as measured by the National Institute of Statistics and Economic Studies (INSEE), the decline in borrowing capacity should be limited to 11% by 2024: a significant decline it is true, but one that can be absorbed by more gradual market developments.

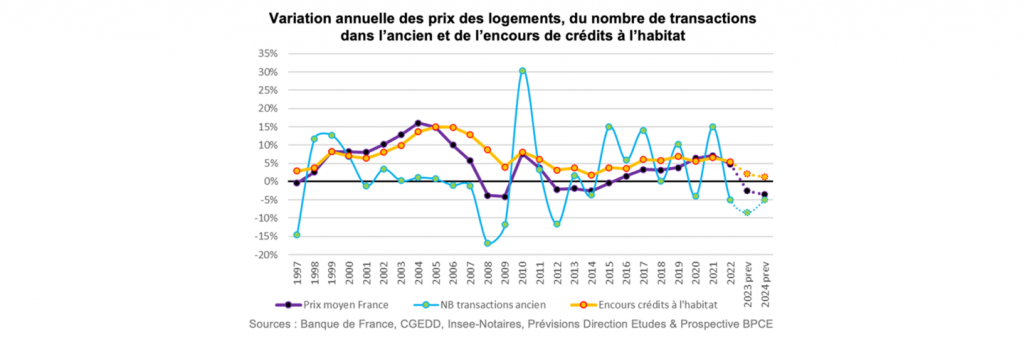

The preferred scenario is therefore one of a more pronounced adjustment in transaction volumes, with a drop of nearly 17% in 2023, followed by 5% in 2024 for existing homes (representing 80% of annual property sales), i.e., 922,000 transactions in 2023 and 876,000 in 2024, for a total decline of 25% from the high point reached in 2021. In France, the adjustments are being expressed primarily, and above all, in terms of volumes, with prices lagging behind and falling to a lesser degree; overall, prices are expected to fall more slowly, by around 3% per year in 2023 and 2024. As a result, the volumes of new home loans are expected to be down by 20% to 25% compared with 2022.

Sources: unless otherwise indicated, all the survey data included in this summary refer to the BPCE L’Observatoire / Audirep Barometer Survey, whose latest inquiry was carried out in February 2023 among 2,061 individuals aged 18 or more.