sur

Central bank currencies: from concept to reality

Tuesday, 19 april 2022

Groupe BPCE’s experts share their knowledge on these new currencies which are emerging and the potential issues they raise.

All these questions and more are discussed by our Groupe BPCE experts – Cyril Vignet, Blockchain Coordination, Digital & Payments, Aline Mottet, Prospective and Innovation at Banque de Proximité et Assurances and Frédéric Dalibard, Head of Blockchain, Technology Expertise & Solutions.

Ever since bitcoin was launched in 2008 by Satoshi Nakamoto, digital currencies (be they public or private) have skyrocketed. It’s no surprise that central banks are taking an interest in the subject and for good reason.

Between technological advancements, the accelerated digitalization of the economy and the revolution of payments, Central Bank Digital Currencies (CBDC) seem to have gone from a distant idea to a widespread reality. In 2021, 86% of central banks had already actively investigated the opportunities offered by CBDCs, compared to 64% four years earlier. In China, there is even a CBDC which is widely used: the digital e-yuan.

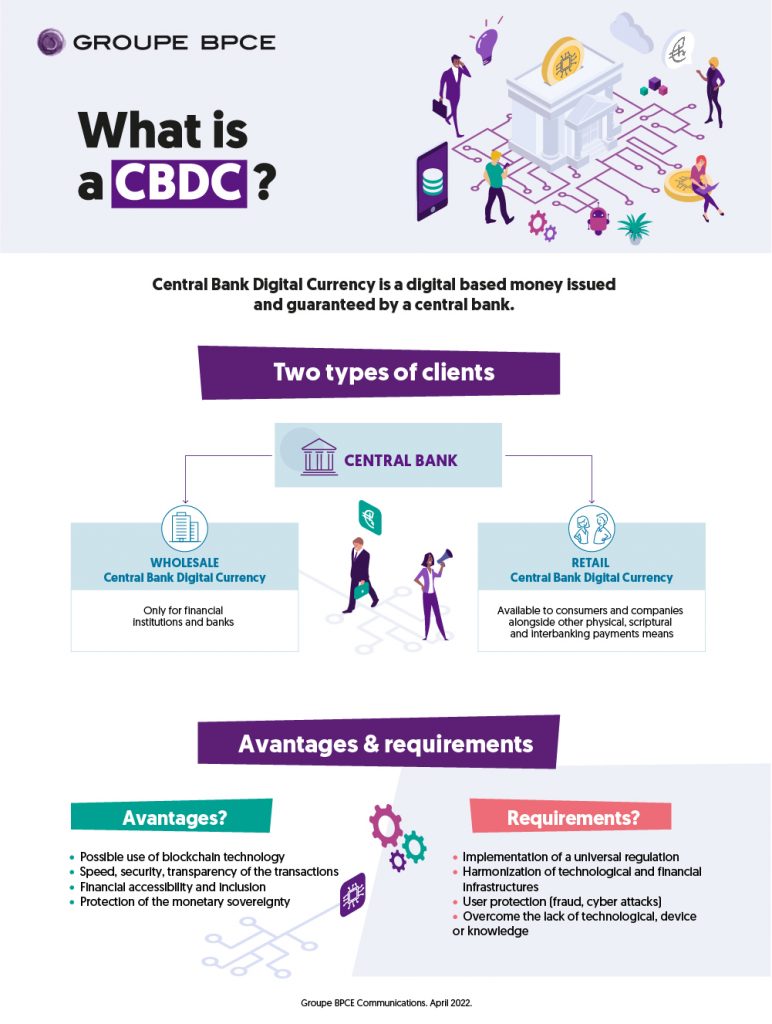

But what exactly are we discussing? What is a Central Bank Digital Currency? What are the potential applications? How can we integrate it into the existing financial ecosystem and benefit everyone?

All these questions and more are discussed by our Groupe BPCE experts – Cyril Vignet, Blockchain Coordination, Digital & Payments, Aline Mottet, Prospective and Innovation at Banque de Proximité et Assurances and Frédéric Dalibard, Head of Blockchain, Technology Expertise & Solutions.

CBDC in the form of graphics